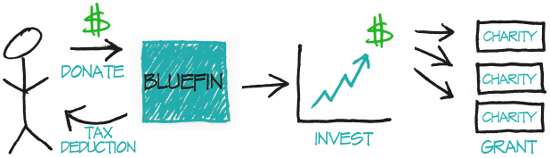

Donor Advised Funds (DAF’s) have exploded in popularity because they make charitable giving easy. Here's how it works:

STEP 1 - CONTRIBUTE

Donors make a charitable contribution to Local Philanthropic and receive

an immediate tax benefit. Contributions can include cash or publicly-traded

investments, like stocks and bonds.

STEP 2 - INVEST

Your contribution is then invested according to your preferences to grow

tax-free, which will allow you to make a larger gift to the charities of

your choice.

STEP 3 - GRANT

You can recommend grants of any size at any time to qualified U.S. public

charities. You can even recommend grants online, making the donation

process a breeze.

Local Philanthropic will do the due diligence to make sure your charity meets IRS guidelines.

Donor advised funds have several advantages that separate them from other giving methods.

SIMPLICITY

DAF’s are easy to set up and require little administrative maintenance

since the fund handles the administrative work, like managing investments,

recordkeeping, tax receipts, and grant administration.

This stands in contrast to private foundations, which must hire staff or outside advisors to manage the administrative work and tax matters for the foundation. They must also form a board, hold board meetings and record minutes, file state and federal tax returns, all at a great expense. They can also take months to establish, requiring significant time and financial investment.

LOW COST

A Local Philanthropic DAF costs nothing to establish and has no legal fees. We charge

a small monthly fee for account maintenance, but we are unique in that

a smaller fee is charged if your account value is lower on the month. View

our

COSTS.

CUSTOMIZED INVESTMENT STRATEGY

Local Philanthropic offers a range of investment styles to accommodate donors

who may be looking to give soon or well into the future.

SUPPORT MULTIPLE CHARITIES

A single contribution allows donors to make grants to as many charitable

organizations as they wish.

CREATE A LEGACY

Multiple successors can be named to the account, which carries on the legacy

of charitable giving.

NAME YOUR OWN FUND

Donors are able to choose the name of their account. Names are often as

simple as the family name (The Smith Family Foundation), but may be named in

honor of a relative, friend, or cause.

ANONYMITY

DAF’s are the only charitable-giving vehicle that allows donors to make grants

with complete anonymity if they choose.

REDUCE ESTATE SIZE

Assets donated are no longer part of the estate value, reducing estate taxes.

Part of the appeal of donor advised funds is that a full tax deduction can be taken with your contribution – before they are eventually donated to your recommended charities.

The size of the deduction depends on the type of contribution made:

CASH DONATION

When donating cash (by check or transfer), donors

are eligible for an income tax deduction of up to 50% of adjusted gross

income.

APPRECIATED INVESTMENTS

Contributions of appreciated publicly-traded

securities are a popular donor method because it eliminates the capital gains taxes

that come from selling investments. Donors will take an income tax deduction in

the amount of the market value of those investments, up to 30% of adjusted gross

income.